Owning vs. Renting

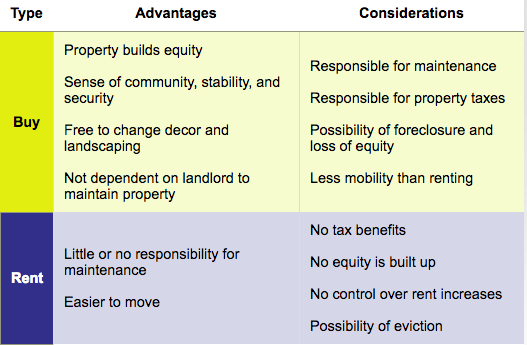

Making the decision to own a home versus renting one is no small decision. Not only does it affect your expendable cash, but it also has a huge impact on your lifestyle and how much money you’re able to save over time.

Sometimes, the goal to achieve the “American Dream” of owning a home clouds some people’s vision for the future and they buy a home when they should really be renting one.

Similarly, there are people who continue to rent for the flexibility and minimal responsibility it offers, even though they would build a much larger net worth over time if they owned a home instead.

Owning a home gets the most attention as it's a big business for everyone from mortgage lenders to real estate agents to home improvement stores. Because of that, we’re hammered over the head that owning a home is the key to happiness.

But again, owning a home isn’t for everyone and for that matter, neither is renting.

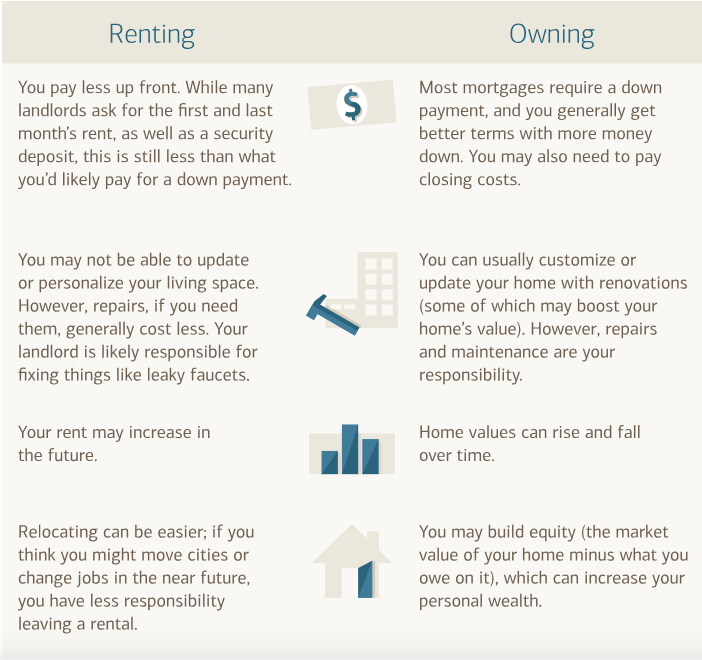

Let’s take a closer look at the pros and cons of each to see whether owning or renting suits you best.

More stability vs More flexibility

Some of the more salient aspects of owning a home are also the more intangible benefits: a sense of stability, belonging to a community and pride of ownership. That said, if you like to travel and be away from home a lot, owning a home might just not be for you.

Also, if you’re not great with money or money is consistently tight, home ownership might not be a good choice either. Real estate is the original illiquid asset. Once you own a home, you’ll still need to spend money to sell it and move...whether the market is great or not.

Some people like the permanence of having their own home, knowing that they’ll live there for the long term. Other people like the ability to live in one place for a year and then be free to live somewhere completely different in a low-cost, easy-to-move environment.

You need to know what you enjoy more and then own or rent based upon what makes you happy.

American dream or not...the decision is yours and it’s not one you should take lightly.

More Bang for your Buck

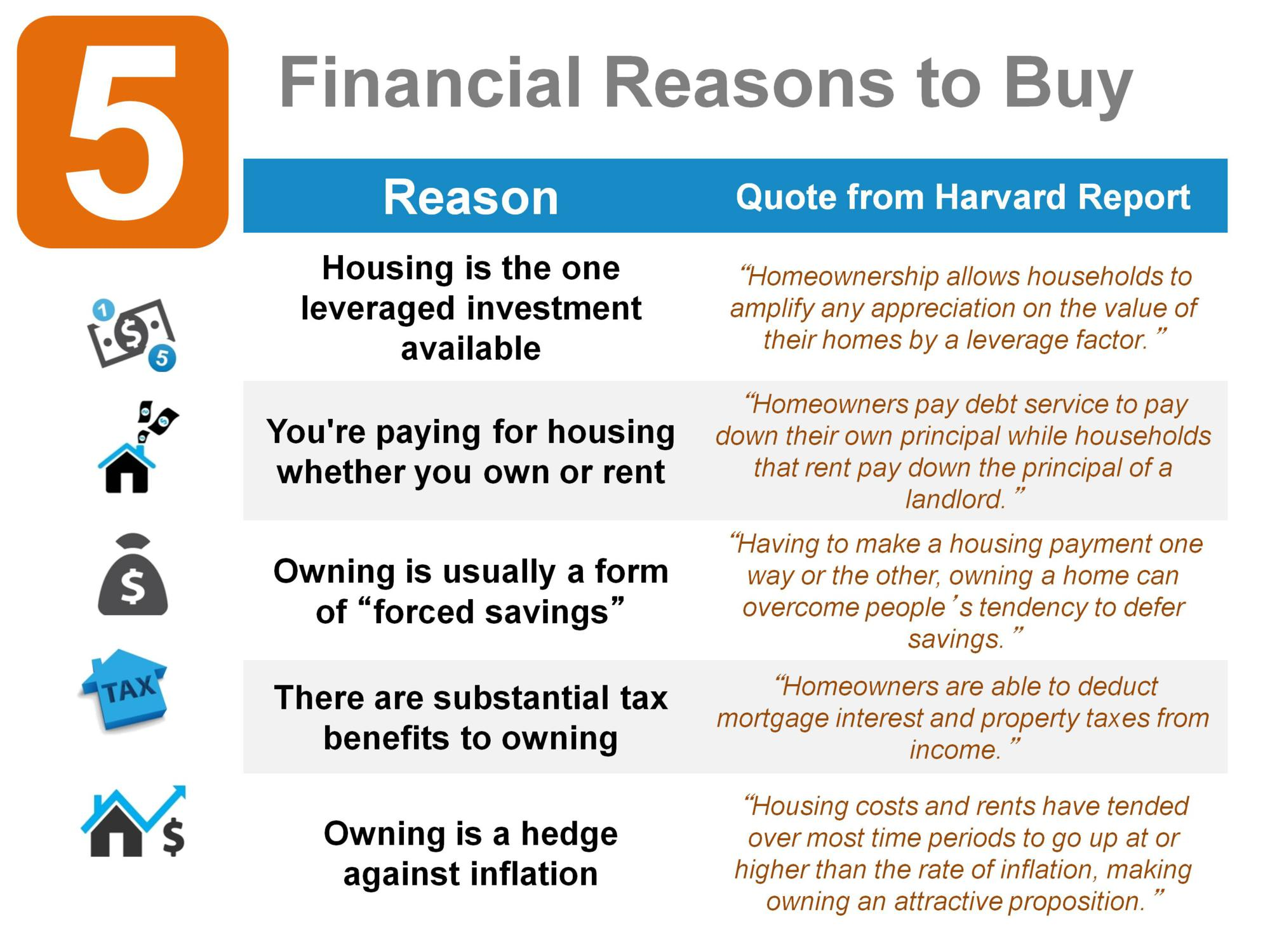

The biggest thing about renting is that for the most part, you’re not getting the best return on the money you spend every month. Yes, you need a place to live and yes, you do get enjoyment and satisfaction from the place you rent, but you could be enjoying where you live and building equity in something for the long term.

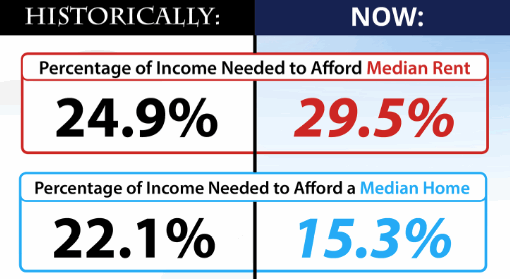

And, what’s surprising, is that owning a home over the long term actually costs less than renting.

Required down payments when buying a home and interest rates have made home ownership more affordable today than ever before, making house payments lower.

Sure, when you own a home, you’re going to have to pay expenses like:

- property taxes

- water and sewer service

- repairs and maintenance

- pest control

- tree trimming

- homeowners insurance

- renovation and upkeep costs

But at the end of the day, your mortgage payment will always be the same as long as you got a fixed mortgage and not an adjustable rate mortgage.

You have to remember, even if you don’t pay these expenses directly as a renter, you still pay for them as the owner of the home/property you rent has to pay for them and they’re looking to make a profit.

That means those expenses get passed along to you in the form of increased rent payments over time.

In addition to that, you get to write off a percentage of the interest you pay on your mortgage every year.

For example, if you paid $3,000 in mortgage interest in a tax year and were in the 30% tax bracket, you could reduce your tax burden by $1,000.

Unfortunately, renting doesn’t give you the opportunity to do that.

Though the cash outlay may seem higher for owning a home, over the long term, owning is financially more feasible.

Before you Buy a Home

Which option is best for you isn’t just about money; it’s also about comfort and your vision for your life.

Despite some of the additional expenses you could incur as well as the additional work you need to do to own a home, many people chose to own instead of renting.

They do that because it provides a more permanent place to raise children. Also, it’s really the only way for you to live in a space that you can completely make your own.

Ultimately, the decision to rent or to own is not rooted only in finances, it’s also based on emotions. Take the time to look at your financial situation and long-term goals before you decide to own or rent a home. The decision you make will take you and your family down completely different paths.

No matter what path it is, you want to be ready and more importantly, you want it to be the right path.